9 min read

Dwell Time Seen Through the EV Charging Lens

EV Adoption and Charging Networks Surge, Transforming Parking Dynamics

Electric vehicle (EV) adoption is growing on an exponential curve, fueled by more and more automotive companies embracing the technology, purchase rebates, and greater component availability as our worldwide supply chains recover. From 2020 to 2021, sales of new electric vehicles more than doubled, an increase of 51.8%. Electric Vehicles market unit sales are expected to reach 2,131.2K vehicles in 2027.11

Lagging slightly behind the sales of EVs—though still growing exponentially—is the installation of EV charging stations. Projections call for 130,000 U.S. charging stations to be operating in 2023, and more than doubling to 290,000 by 2027. 22 According to PwC analysis, EV infrastructure is projected to grow to ~$100B by 2040, with the fastest-growing segment expected to be the at-work segment, followed closely by multi-unit residential (apartments).33

This paradigm shift from internal combustion to electric vehicles is significant from an environmental, sociological, and yes, parking perspective. This article will explore some of the considerations and opportunities associated with this sea change in mobility.

The good news is that EV charging station deployment can positively affect every type of parking application, with benefits ranging from new customer attraction, additional revenue models, and increased dwell times.

There are three types of electric vehicle supply equipment (EVSE); Level 1, Level 2, and Level 3. Understanding the different charging methods can help a location maximize electrical capacity, optimize infrastructure budgets, and meet user expectations.

Level 1

Level 1 EVSE provides charging through a common residential 120-volt (120V) AC outlet. Level 1 chargers can take 40-50 hours to charge a battery electric vehicle (BEV) from empty and 5-6 hours to charge a plug-in hybrid electric vehicle (PHEV) from empty.44 Level 1 chargers are primarily designed for the home market or long-term parking like hospitals or airports due to their slower charging times. Level 1 EVSE are not typically funded by incentive programs and generally do not accommodate software platforms that would allow for billing an EV driver for use of the station.

Level 2

Level 2 EVSE offers charging through 240V (in residential applications) or 208V (in commercial applications) electrical service, and is common for home, workplace, and public charging. Level 2 EVSE can charge a depleted BEV battery in 4-10 hours and 1-2 hours for a PHEV.55 For “workday” parking (~8 hours), Level 2 chargers offer a good solution.

Level 3 or DC Fast Charging (DCFC)

The fastest speed, direct current fast charging (DCFC) equipment, enables rapid charging. DCFC deployments are often found along heavy-traffic corridors and locations with naturally shorter dwell times such as convenience food locations or highway rest areas. DCFC equipment can charge some BEVs to 80 percent in just 20 minutes and most in about an hour.66 Most PHEVs currently on the market are not compatible with DC fast chargers.

Level 3 chargers allow drivers to optimize shorter stops to fuel their vehicles. Cars can be refueled in parking garages utilized by shoppers, or while their owners are at highway rest stops or grocery stores. Additionally, they will be critical in the success of current fleet electrification efforts nationwide.

Potential Benefits for Parking Locations Proximate to Retail Through EV Charging

Parking locations utilized by retail patrons are uniquely positioned to expand public charging infrastructure by installing EV charging stations. Hosting an EV charging station offers a range of potential benefits for retailers, including direct revenue from charging station use, increased sales due to dwell time, and improved corporate branding.77

Retail establishments—both as places of commerce and employers—are ideal candidates to serve as site hosts for EV charging stations. Hosting EV charging stations offers distinct advantages to retailers including:

- Increased in-store retail sales from customers spending time in stores while waiting for their vehicles to charge

- Corporate branding as environmentally conscious

- New revenue streams from the direct sale of charging to customers or advertising revenue

- Customer and employee attraction and retention

In their seminal 2020 study of public charging at retail sites, Public EV Charging Business Models for Retail Site Hosts, Atlas Public Policy detailed the following insights:88

- High utilization is critical for achieving profitability

- Grant funding is important for mitigating the risk of unprofitability

- Higher number of charging stations per site offered savings on fixed site costs

How Dwell Time Affects Retail Spend

The Atlas retail parking study examined dwell time and the effect on retail revenue, and detailed the following insights:

- To optimize sales revenue, retail site hosts should design fee structures to achieve longer dwell times, but also create sufficient customer turnover, as in-store retail revenues per customer tapered off after extended dwell time. The increase in average station net present value (NPV) between scenarios with a 25 and 50-minute customer in-store dwell time was over five times greater than the increase in average NPV between scenarios with a 50 and 75-minute in-store dwell time.

- Retail site hosts with lower expected customer spend per visit should focus primarily on achieving a high turnover of customers. Doubling station utilization for scenarios that had a maximum expected customer retail spend of $25 increased the number of profitable scenarios to above 90 percent.

- Retail site hosts should use information on average in-store customer revenue per minute to design fee structures that optimize dwell time for their business. Retailers with low expectations of customer spend per minute can achieve the same sales revenue as more expensive retail locations by choosing a fee structure aimed at increasing customer dwell time such as session-based fees or free charging for a set period of time.

Dwell Time in Non-Retail Charging Locations

Parking facilities not proximate to – or associated with retail such as workplaces, hospitals, universities, and transportation-related (airport, train station, ferry) have a different set of criteria when considering EV charging station dwell time. These facilities can benefit from installing EVSE as a way of positioning the facility as a preferred parking location and profit from revenue from charging fees, and fees from advertising displayed on individual chargers.

The four pricing models used in these settings include free, hourly rate, fee per kWh dispensed, and flat fee per session. Due to the inherently longer dwell times anticipated in these locations, Level 2 chargers can prove adequate to meet most charging needs. However, there may be additional opportunities to monetize level 3 chargers in the same locations in areas with fast-turnover spots, for example, hospital visitor lots or outpatient service centers, workplace visitor areas, downtown areas, and entertainment venues – all of which feature shorter-duration parking, where drivers might be willing to pay a higher fee for a rapid charge.

Ultimately, lot operators need to define what the goals of an EVSE deployment are for their location(s). Fully charge a vehicle in a short time? Provide a convenient amenity on-site for users of the lot? Create a new revenue source for the lot? Can our current electrical infrastructure handle an EVSE deployment?

These are the questions to begin with. What will follow is an execution on those goals. At this phase, things to consider are: are we deploying upgradable systems? Are we deploying scalable systems? Are we deploying systems with flexible operating systems (non-proprietary hardware)? Are we deploying enough chargers for today or tomorrow? The bottom line is that lot operators will need to develop comprehensive plans to bring smart solutions to their existing and future locations. Those plans, in conjunction with good partners, will generate short returns on investment and high levels of customer satisfaction.

Vice President of North American Sales at Livingston Energy Group

Three Different EV Charging Business Models

Partner Owned

For those interested in owning the charging infrastructure and collecting revenue, the responsibility for procuring, installing, and maintaining the station falls on the parking location owner—unless the charging service provider offers a full-service solution. The site host enjoys complete control over fees set for vehicles utilizing the stations, but also must coordinate with their electric utility company to obtain permits, coordinate station maintenance, and cover all operating costs associated with the charging infrastructure.

Cooperatively Owned

A joint investment between the parking location owner and charging service provider on the cost of the installation project and the two parties share the station’s revenue. Options often exist where for lower investment and a smaller share of the revenue, the parking location owner enjoys the freedom of leaving the “heavy lifting” of permitting, installing, and maintaining the infrastructure to the charging service provider.

Operator Owned

Parking location owners get the charging amenity for their customers without needing to invest the time or money into building, managing, and maintaining the stations. Third-party owner-operators collect revenue directly from their charging stations and may charge software subscription fees for membership to their charging station network, and the actual use of a station. These usage fees can be per unit of electricity delivered or per-minute charging fees.

Funding Available for EV Infrastructure

To encourage to buildout of EV charging infrastructure, there are many federal, state, local and utility incentive and grant programs that can help defray the cost of EVSE projects. One such program, as part of the bipartisan Inflation Reduction Act (IRA), is the National Electric Vehicle Infrastructure (NEVI) Formula Program.

While not applicable to all parking situations, this grant program is designed to help create an interstate network of charging stations across the country.

Administered by the U.S. Department of Transportation (DOT), The NEVI Program will provide funding to states to build electric vehicle (EV) charging stations in an effort to establish an interconnected network to facilitate data collection, access, and reliability. According to the DOT, funding is available for up to 80% of eligible project costs for charging stations meeting these criteria:

- 24/7 public access to chargers

- Located within one mile from a corridor (designated highway)

- At least four (4) parking spaces served by 150kW Direct Current Fast Chargers (Level 3 DCFC) with Combined Charging System (CCS) ports capable of simultaneously DC charging four EVs; a minimum station power capability at or above 600kW

- Walkable amenities with public access (bathrooms, food vendors or vending machines, etc.)

NEVI is one of the many programs available to encourage and assist EV charging station buildout. Consult with your EV charging hardware supplier or installer to identify programs available in your location. Some suppliers feature a funding department that can perform the identification and procurement of incentives and grants.

References

1,2. Statista, 2023, https://www.statista.com/outlook/mmo/electric-vehicles/united-states#units

3. PwC, 2023, The US electric vehicle charging market could grow nearly tenfold by 2030: How will we get there?, https://www.pwc.com/us/en/industries/industrial-products/library/electric-vehicle-charging-market-growth.html

4,5,6. U.S. Department of Transportation, February 2, 2022, Electric Vehicle Charging Speeds

7,8,9. Charles Satterfield and Nick Nigro, Atlas Public Policy, April 2020, Public EV charging business models for retail site hosts – A Financial Analysis of Common EV Charging Business Models for Retail Site Hosts.

Related Insights

Discover news, perspectives, education and more from Lynkwell’s team of experts.

Two EV Experts, One Powerful Conversation

In May, Nick Bordeau, VP of Software Engineering, was honored as Tech Leader of the Year by the Electric …

Warranties vs. SLAs: How to Secure Your EV Charging Investment for the Long Haul

In a rapidly evolving EV (electric vehicle) charging landscape, ensuring charger reliability and operational stability i…

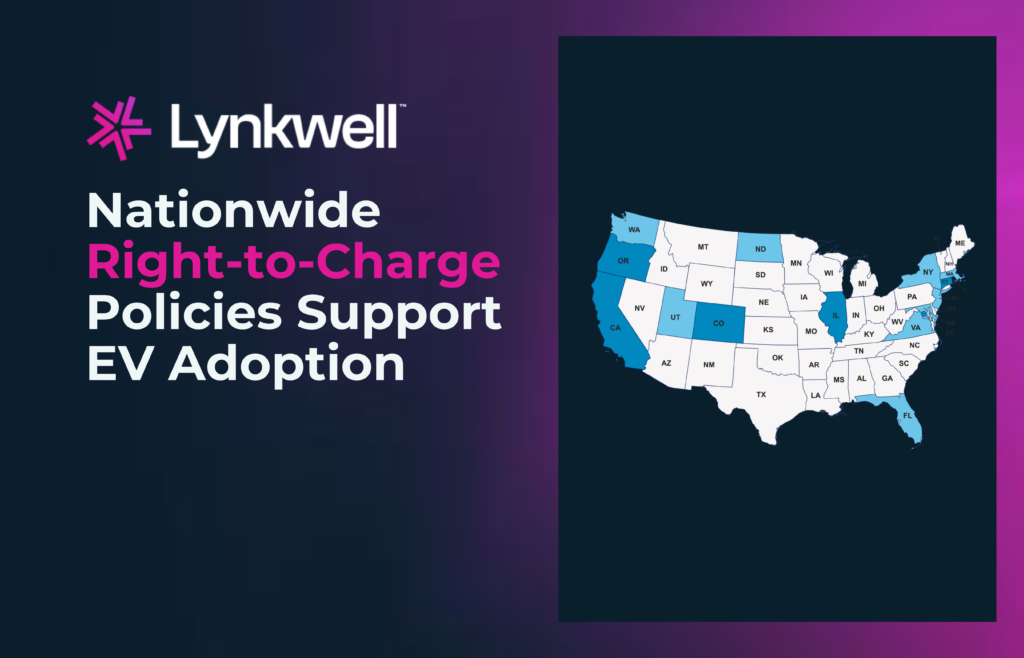

Nationwide Right-to-Charge Policies Support EV Adoption

As the adoption of electric vehicles (EVs) grows rapidly, ensuring equitable access to affordable EV charging is becomin…